Mastercard recently announced its tie-up with a working group supporting blockchain research and education at universities all over the world.

The Blockchain giant MouseBelt declared this Tuesday that it had appointed 11 new founding members in its Alliance for Blockchain Education. Besides the card network, the members consist of innovation subsidiaries of Ripple, the payments startup and Binanace, the crypto exchange leader. The members also include a list of diplomats from KuCkin, Neo, and ethereum, who are scaling the Matic Network. These representatives are to join 13 new companies, such as Stellar, Wanchain, and TRON, that became a member of the coalition after it was inaugurated in October.

The Alliance for Blockchain Education is a unit of the university program of MouseBelt. Mouse belt is an undertaking to educate and train the budding blockchain developers across 80 student associations worldwide. Members offer funding as well as educational resources, which could help the professors and their students construct curriculums while staying updated with industry trends.

Ashlie Meredith, director of MouseBelt University said,

The members all share our ethos: The best way to invest in space is to make long-term investments in education. The better the education, the better developers and projects we will see.

MasterCard, being one of the greatest payment providers of the world, handles payments worth over $14 trillion each year. Over the last couple of years, it has made strides towards the arena of blockchain technology. One major move towards this was its collaboration with Facebook’s Libra as one of the Founding Members.

Both Visa, as well as Mastercard, leave the collaboration in October admits the legal and regulatory concerns.

Ajay Banga, the CEO, said that he had reneged the company’s coalition with Libra due to the concerns revolving around the regulatory status of the project as well as its viability for the long-term. Mastercard still hasn’t spoken on the reasons that persuaded it to join the Blockchain Education Alliance. A number of media agencies are chasing the company for a response on this and the real reasons are soon to be out.

The Alliance started as a union of over 13 North American universities as has touched over 70 schools all over the Americas. It has also reached some schools from Asia and Europe. Warren Paul Anderson, the chief of developer associations at Ripple’s Xpring, spoke that being a part of the alliance has enabled it to prep and hone the skills of the future developers with the right resources and assets.

He said,

Mousebelt’s mission to promote blockchain technology at the curriculum level within universities is directly aligned with that of Xpring.

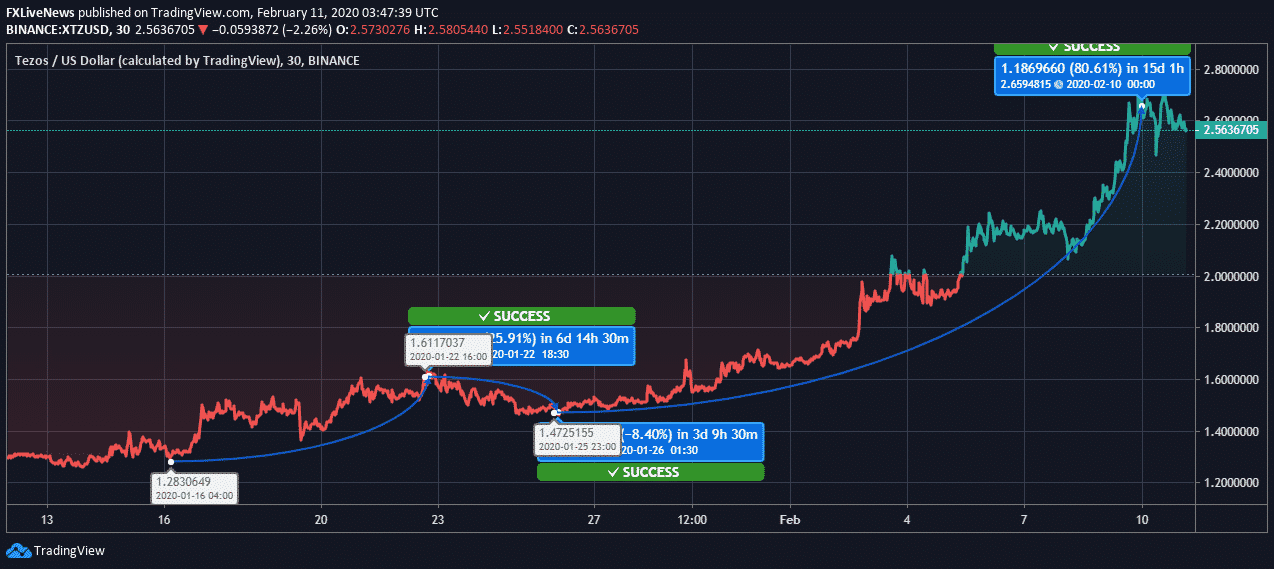

From then on, Tezos coin marked strong upward momentum and succeeded in pushing its price in the higher range to $2.6594 on February 10, showing an upward price swing at a whopping 80.61%. The current day’s price of XTZ coin has fallen slightly to $2.5636.

From then on, Tezos coin marked strong upward momentum and succeeded in pushing its price in the higher range to $2.6594 on February 10, showing an upward price swing at a whopping 80.61%. The current day’s price of XTZ coin has fallen slightly to $2.5636.