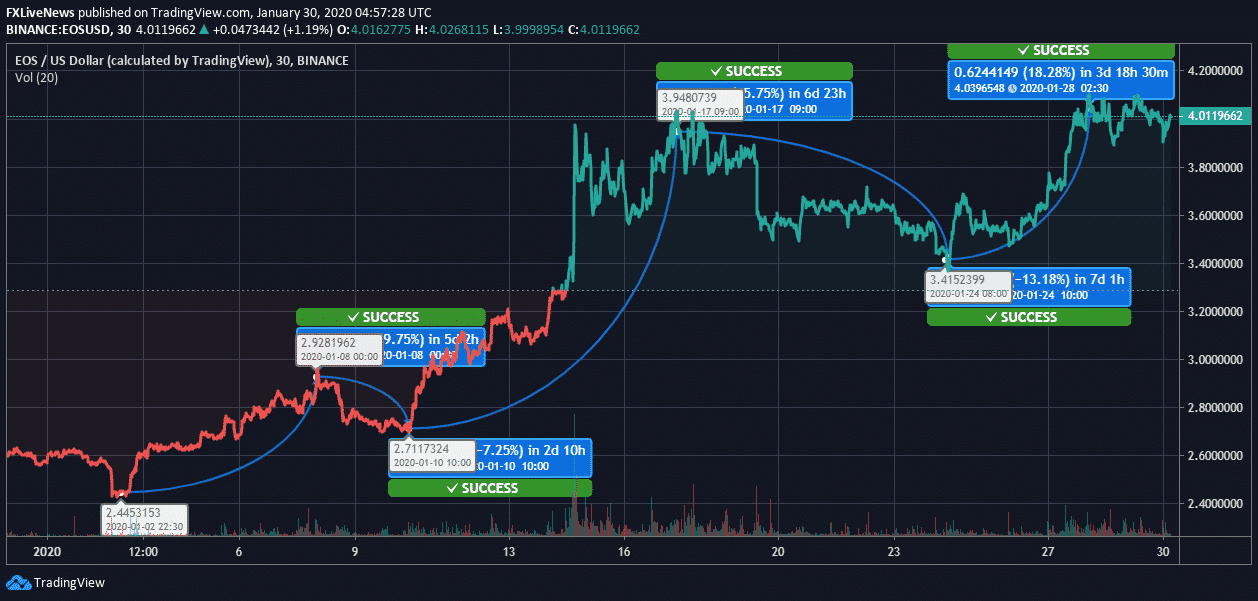

EOS coin is currently trading under market pressure. The currency is indicating loss for the intraday traders. However, in the broader picture, the coin has improved miraculously since the opening of the year.

The 30-days high price is $4.39, and if we compare it from yesterday’s high which was at $4.34, the difference is marginal. It looks like that in the coming days, the 30-days high would be breached. The future speculations of colossal profit are ripe.

EOS Price Analysis

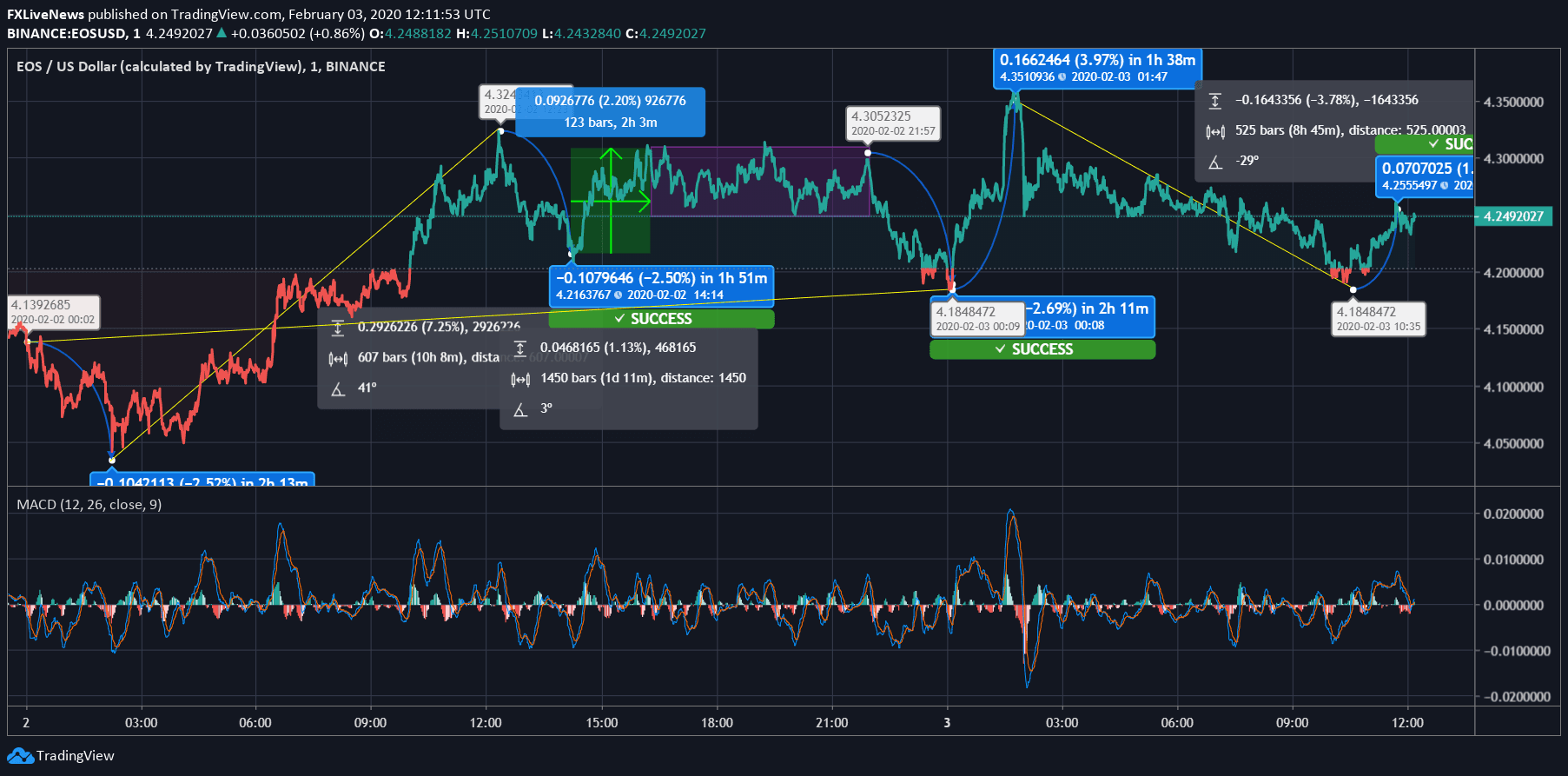

EOS was at $4.13 at 00:02 UTC on February 02, 2020. Within the first couple of hours, the coin dribbled to $4.01 by 2.53%. The price began escalating and it touched $4.32 by 7.25%. After an astounding jump, the EOS price slipped to $4.21 by 2.50%. The coin picked up to $4.03 at 15:15 UTC and remained locked at the same level. In the closing hours, the price plunged to $4.18. The day-long movement reflected a 1.13% profit in the price.

Today, within 1 hour and 38 minutes, the currency escalated from $4.18 to $4.35 by 3.97%. Further, the currency dropped to $4.18 by 3.78% fall. Recently, EOS coin has exhibited improvement. The coin is now at $4.25.

As per the MACD indicator, the signal line and the MACD line recently collided, and MACD overpowers the Signal line. The same caused a change in trend, and thus despite heavy pressure, EOS coin slightly recovered. The same might bring improvement in the momentum of the coin.

The current price of EOS is tilted towards the immediate resistance level at $4.35. The same might get violated by the end of the day. However, if pullback pressure takes the coin down, then the immediate support level is formed at $4.08.

R1: $4.35, R2: $4.48 and R3: $4.62

S1: $4.08, S2: $3.94 and S3: $3.81